Life Insurance and the pandemic

- Gloria Isaac

- Sep 29, 2021

- 2 min read

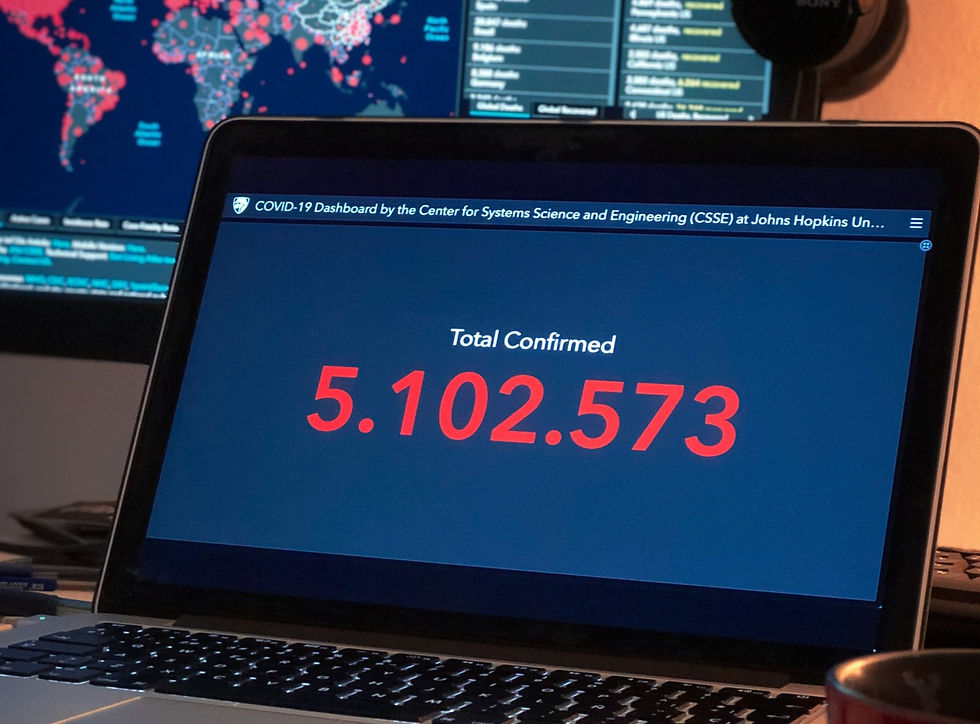

That the world is currently experiencing a pandemic is no secret to any of us. The number of affected people and the high number of deaths continue to rise. And what of the financial, emotional and spiritual health of nations worldwide? This reality should be cause for concern by each individual.

From a family perspective, my questions to each adult during this period are:

- What financial and emotional position would you leave your family should you contract covid-19 and die tonight?

- How would losing your breadwinner during this pandemic affect your family?

- Would your family be able to manage financially?

- Would they be able to enjoy the lifestyle to which they have been accustomed?

- Would the children in your family be able to receive an education?

- Would your final expenses be paid for?

- Would your mortgage loan be repaid?

Generally, one of the responsibilities of each generation is to create generational wealth and leave behind legacies to better the lives of each successive generation. Never think you do not have enough to leave for your family. One of the fastest ways to create a legacy for your family is through life insurance.

Of special note is the fact that payouts to your beneficiaries are tax-free!!

Based on your individual needs and budget, choosing the correct solution can be overwhelming. The haystack of options makes it even more so, but customizing a solution for you can best be handled by a licensed and experienced life insurance agent.

Some reasons you may need to talk to a life insurance agent are:

- Do you have a family?

- Do they rely on you for financial support?

- Do you have a mortgage loan?

- Have you made provisions for your burial and final expenses to be paid in full?

Did you know that life insurance is not just for paying death benefits? It isn't! Life insurance can also:

- pay living benefits for chronic, critical and terminal illnesses;

- offer return of premiums if you outlive some contract term;

- be used to complement your retirement funds;

- be used to save towards your long term care;

- provide for business continuity;

- provide loans which you do not have to pay back;

- offer strategies for you to ensure you never outlive your income

and so much more....

Noting that life insurance is bought not just with money but with your health and other factors, it is recommended that you get your situation reviewed every two years. Life insurance offers many possibilities but, do not wait until after you have been diagnosed with an illness to consider it. Although some companies do cover some ailments, sometimes it is with a "rated" premium and sometimes they decline your application.

With the many benefits offered by life insurance, now is the time to think about ensuring that you have your portfolio is reviewed. The pandemic is no joke, it is claiming lives each day. We do not know who will be next. Why not ensure that your family is protected? What better way to ensure your contribution to your future generations and to be known and remembered by your family.

Talk with a life insurance agent today.

Gloria Isaac

Independent Life Underwriter

Linkedin: https://www.linkedin.com/in/gloriaisaac/

Website: https://GloriaIsaacInsurance.com

Comments